This type of terms will tell the amount youre borrowing from the bank, the rate, in addition to repayment timeline. Although not, in place of make payment on cash return to help you a financial otherwise financial, you will be paying off it to their advancing years account. ?Unlike most other old age membership distributions, you don’t need to shell out fees or penalties as long as you pay-off the mortgage according to installment terminology. ?

Eligibility standards

If you are zero credit check must be recognized to have a great 401(k) mortgage, there are particular qualification requirements that must definitely be satisfied.

For those who have a fantastic mortgage and would like to shell out it off ahead of requesting a new one, you could do very during the Finance webpage of participant dashboard.

Loan minimums and you can constraints

That have an excellent 401(k) mortgage, there are certain limits so you’re able to just how absolutely nothing otherwise how much cash your can be borrow. ?The minimum count try $step one,000. The absolute most relies on your bank account balance and you will if you have got a separate financing before 12 months. ?The brand new algorithm for deciding maximum ‘s the smaller out-of:

Example step 1: Graham provides a great vested balance off $75,000 and also never ever removed financing off their 401(k) bundle.?The maximum amount he can simply take ‘s the minimal off:

Maximum loan Graham may take was $37,five-hundred.??Analogy 2:Yasmin have an effective vested account balance of $250,000 and you can paid off her past mortgage out-of their 401(k) bundle 2 years before.?The absolute most she will grab ‘s the lower of:

The maximum loan Yasmin takes is actually $50,000.??Analogy 3:Ryan enjoys good vested account balance out of $250,000. Five weeks before, he paid down their a fantastic 401(k) loan with a payment regarding $25,000. Now, the guy would like to take-out an alternate financing.?The most the guy discovered is the cheaper off:

Cost terms

Whether your financing is approved, you’ll have to pay off the borrowed balance having appeal, that’s step one payment section above the current best rates. Please be aware that most desire goes myself back into your bank account for your benefit. ?Finance have to be paid back inside five years, or a decade in case it is with the acquisition of a first home. ?Getting Riverside loans financing words beyond five years, you’ll want to submit among the following the data files in order to Guideline as well as the loan request:

A duplicate of your property purchase arrangement finalized from you and you may owner, including the closing date and you will balance of cost, or

Otherwise repay the loan, plus focus, with regards to the loan words the loan is a considered distribution. Any outstanding amounts up coming be nonexempt (and may end up being subject to a great 10% very early shipping penalty).

For many who leave your existing business, you may be necessary to pay off one an excellent financing balance for the complete within this 3 months, or your loan will become a taxable delivery (and could feel at the mercy of a ten% very early shipments punishment).

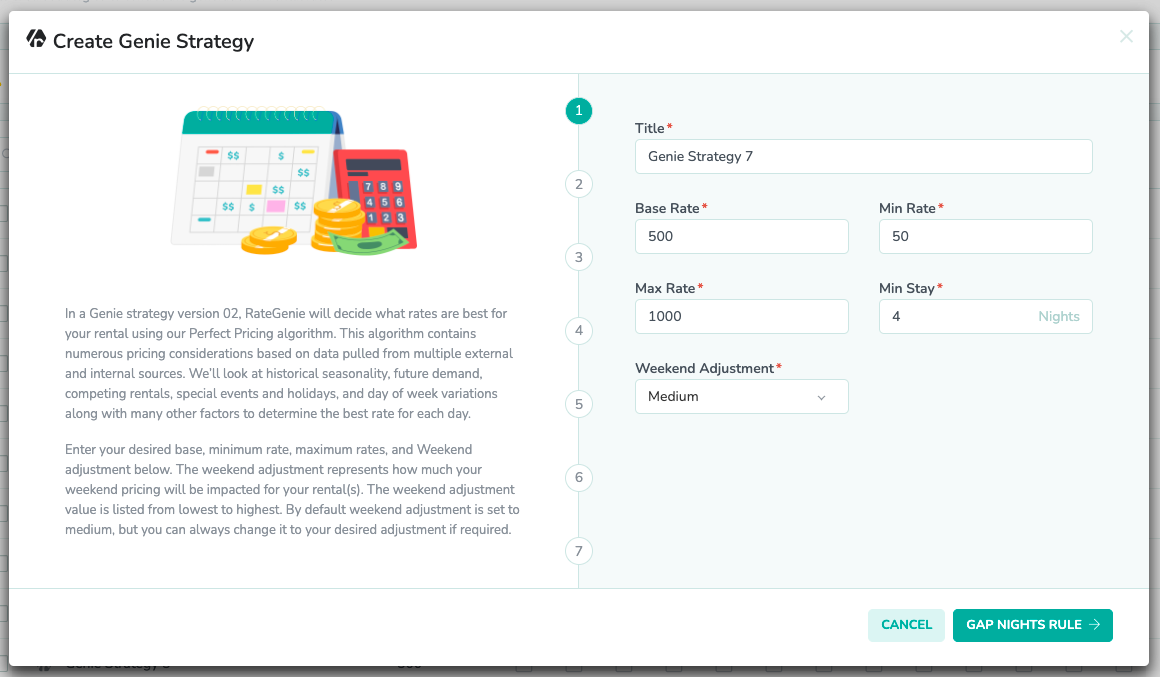

You’ll then end up being presented with all withdrawal possibilities in order to you, along with information regarding for every. When you’re eligible for financing, look for that choice on the webpage. In the event you commonly qualified, the borrowed funds solutions will be grayed aside, and you might select a conclusion off as to why.

You’ll then get important terms and conditions otherwise details from a 401(k) mortgage. After you have read through all the info, click on the key to maneuver send, and will also be guided through the application techniques.

After you fill out financing demand, you can preserve track of the newest condition by the accessing the experience webpage beneath the Transfers selection. You will discovered email announcements as you struck some other milestones when you look at the the loan processes, such as for example should your software might have been acknowledged otherwise if the money are on the way in which.