It is possible to rating an effective 20K do it yourself financing inside the several different ways

Simply specific home improvements are eligible for income tax deductions. The latest Irs makes a significant difference anywhere between what are correct developments and you may exactly what are only simple fixes. Merely true advancements try tax-allowable. Real advancements, also known as financing improvements, was home improvements that add worthy of to your home, lengthen their of use lifetime, otherwise adjust it so you can the new uses. A few examples away from financing improvements start around a separate rooftop, a different Hvac system, otherwise another hot-water heater. Since response https://paydayloanalabama.com/redland/ is far less obvious because the an easy sure if any, when you yourself have any questions from the even if your house update methods are believed income tax-deductible, you will want to consult with your taxation associate.

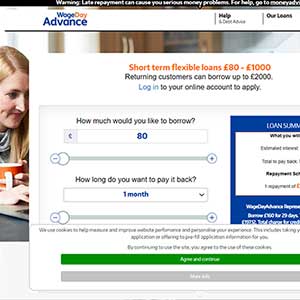

Here’s a report about probably the most popular brands from resource that individuals like while looking to accomplish $20,000 value of home improvements on the property

- Framework so you’re able to permanent loan:A homes so you’re able to permanent financing gives you the money need to complete your house renovations in the installments which are paid down to the fresh new company in the completion out-of particular milestones. For this brand of financing, you will be doing work really that have anybody regarding lender whom commonly check our home to make sure build has been accomplished because the organized and on time. The financial institution will also have an appraisal of your house become held that will dictate the latest worthy of and the possible worth of the home because the reount might possibly be determined by brand new forecast value of the home adopting the home improvements. Immediately following design is done, with the rest of the building mortgage goes to your yet another no. 1 fifteen otherwise 29-seasons mortgage.

- Fannie mae HomeStyle loan:Fannie mae was an authorities organization that can offer people HomeStyle finance which enables someone to potentially obtain up to 95% for the future worth of their residence after reount cover from the 80% into the future property value property which then does not need the citizen to purchase a personal Home loan Insurance. People Homestyle loan that is offered having an amount one to range between 80% so you’re able to 95% of your overall coming worth of the home and the resident is required to spend Private Financial Insurance rates.

- FHA 203k rehab mortgage:A keen FHA 203k rehabilitation loan allows a resident to probably borrow around 96.5% for the future worth of their home. Once again, some thing significantly more than 80% for the future value of the home and the citizen try necessary to shell out Private Financial Insurance. A keen FHA financing is ideal for someone who have less than stellar credit because FHA conditions include less strict than just private lenders. You might however be considered that have a credit rating only 500. When you yourself have a credit rating anywhere between 500 and 579, you might nevertheless qualify for a keen FHA 203k treatment loan having a great ten% down-payment. When you yourself have a credit history away from 580 or better, you can be eligible for the fresh new FHA loan having an effective step three.5% downpayment.

- House equity mortgage:A property security mortgage borrows against the collateral of your house. Collateral relies upon the difference between the worth of your house together with most recent mortgage equilibrium. This is a-one-go out repaired-speed loan that can uses the house as the collateral so you’re able to safe the borrowed funds.

- Family guarantee line of credit:A home guarantee line of credit is a lot like property equity mortgage apart from good HELOC is actually an effective revolving line of credit as you are able to borrow against. Borrow very little otherwise up to you desire up against the number your qualify for over a predetermined amount of time.