So it associate-friendly chart makes you rapidly know if your wanted location qualifies having a beneficial USDA Mortgage, opening gates so you’re able to sensible financing choice and you may a rewarding existence inside the your dream society.

Strategies for new DSLD Home loan USDA Financing Qualification Chart

Having fun with our very own map is straightforward! Merely type in the latest address of the property you’ve discover, plus the chart commonly instantly show you if this falls contained in this a good USDA-qualified area. Portion highlighted when you look at the red try ineligible, if you’re components versus purple shading meet the requirements to own USDA Financing. Its that easy to get going in your road to homeownership.

What is a great USDA Loan?

A good USDA Mortgage, supported by the us Company away from Agriculture, is actually a government-insured home loan tailored especially for reasonable- to help you moderate-earnings homebuyers in the qualified rural components. USDA Finance render multiple experts which make homeownership way more obtainable, including:

- Zero down payment specifications : USDA Financing generally speaking don’t need an advance payment, reducing the fresh monetary weight of buying a home.

- Low interest rates : USDA Financing often have aggressive rates of interest, to make monthly obligations more affordable.

- Flexible loan places Avon borrowing from the bank criteria : USDA Financing much more easy having credit scores compared to Antique Money, starting gates to a greater list of customers.

- Smaller home loan insurance coverage: USDA Funds keeps straight down home loan insurance fees than other loan sizes.

When you need to carry out a lot more search before taking another action on the Western Fantasy, here are a few our publication, What is A beneficial USDA Mortgage?

How the USDA Eligible Property Chart Functions

To be eligible for a good USDA Loan, the house or property you are interested in must be based in an effective USDA-appointed eligible town, while the revealed with the our very own map.

While USDA Fund are usually on the outlying elements, brand new eligible elements try greater than you possibly might believe! Of a lot small towns and you can residential district groups slide within the USDA’s meaning off rural. Use the entertaining USDA Eligibility Chart and discover a number of away from locations that could well be ideal for your next home.

- Top home : The house or property must be used as your no. 1 home, perhaps not a holiday home otherwise money spent.

- Smaller size : Centered on USDA advice, a property is recognized as smaller in proportions if it is around dos,000 square feet. However, you will find conditions, therefore it is really worth contacting financing Officer having knowledge of USDA Financing.

USDA Mortgage Eligibility Criteria

Outside the property’s place and you can status, you will need certainly to see certain debtor qualification requirements so you’re able to qualify to possess an effective USDA Mortgage. These conditions include:

- Money limitations : Your earnings need fall from inside the USDA’s income limits for your area.

- Creditworthiness : While you are there’s no minimum credit history criteria , a beneficial credit rating can also be change your probability of approval and you will safer top financing terms.

- Debt-to-money ratio : The debt-to-income ratio is always to have demostrated what you can do to repay the mortgage.

If you have experimented with the newest USDA eligibility property chart however they are still not knowing for folks who meet all qualification requirements, reach out to DSLD Mortgage’s knowledgeable Loan Officials . They could speak you through the use of this new USDA Qualifications Map and upcoming present tailored pointers based on your financial situation and homebuying goals.

Talk about The USDA Loan Selection having DSLD Home loan

DSLD Home loan will be your top partner in the tackling new USDA Financing processes. Our knowledgeable Financing Officers concentrate on assisting you find the better money solution to your requirements.

Whether you are using our very own USDA Mortgage urban area map to understand USDA Loan-eligible portion or simply just contrasting the newest USDA credit chart status, our company is here to help you.

We’re going to help you know if a beneficial USDA Loan is good having you and direct you from means of securing a USDA Financial to suit your fantasy home. We can also help you know the newest subtleties of the the fresh style of the fresh USDA Eligibility Chart, making sure there is the most upwards-to-big date information.

The USDA Eligibility Location: Initiate The Travels Today!

If you believe you located an aspiration family that meets the newest USDA Mortgage Qualification Map requirements otherwise is actually enthusiastic about a beneficial higher venue into the USDA Financing degree chart you to brings out their interest, don’t hesitate to touch base. We could help you understand the USDA Eligibility Chart in detail and you will make suggestions to the shopping for your perfect USDA-eligible assets.

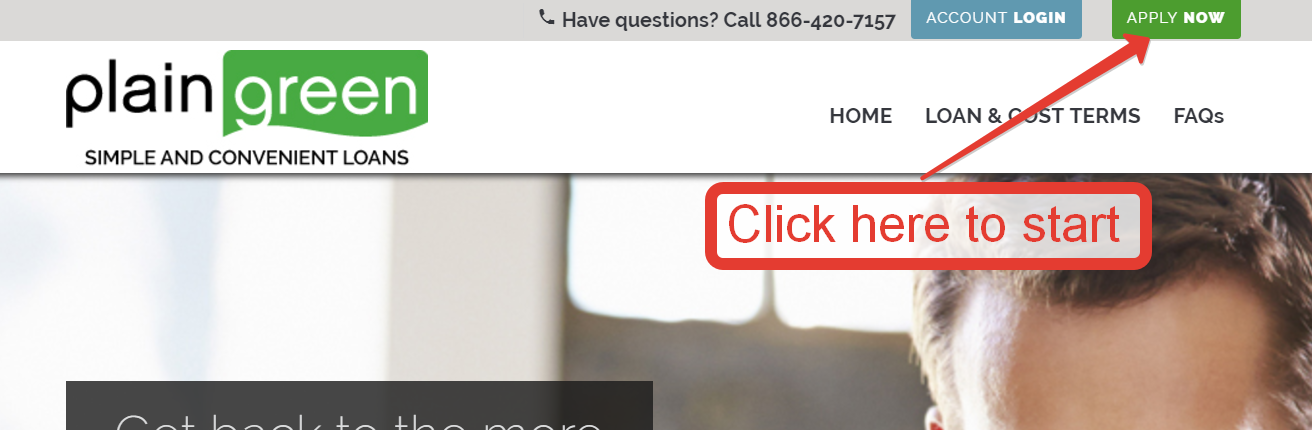

Willing to mention the possibilities of another type of style of way of living? Make the starting point toward dream family of the asking for a good 100 % free consultation having an effective DSLD Financing Administrator . We will make it easier to determine your own eligibility, respond to questions you have got, and you may assist you through the pre-qualification procedure. Dont overlook the opportunity to create your homeownership ambitions a real possibility!