Experiencing their residence’s equity should be useful in different ways. You have access to the bucks wanted to cover high costs, improve your finances and for anything the truth is fit.

Nevertheless, it is critical to proceed which have caution when borrowing from the bank up against the roof more than the head-inability and come up with punctual money can lead to property foreclosure

What exactly is family guarantee?

Family equity is the percentage of your residence which you have paid off regarding. It’s the difference in exactly what the house is really worth and how far has been owed in your mortgage. For many, collateral of homeownership try a switch solution to create personal riches through the years. Since your house’s value increases across the long term while pay down the primary towards home loan, your own collateral develops.

Guarantee provides of many possibilities to property owners, as it’s a origin for offers as well as for resource, states Glenn Brunker, chairman from the Ally Domestic. Such as for instance, the new guarantee gathered from inside the a beginning family can get later deliver the down payment must buy more substantial house as the a family grows and requirements extra space. It’s an occasion-examined answer to build money.

Domestic equity is typically utilized for large expenses and frequently means a costs-effective capital choice than handmade cards or unsecured loans with a high rates of interest.

Exactly how home guarantee performs

The most common a method to availableness the latest guarantee in your home is a HELOC, property guarantee loan and you can a funds-away refinance.

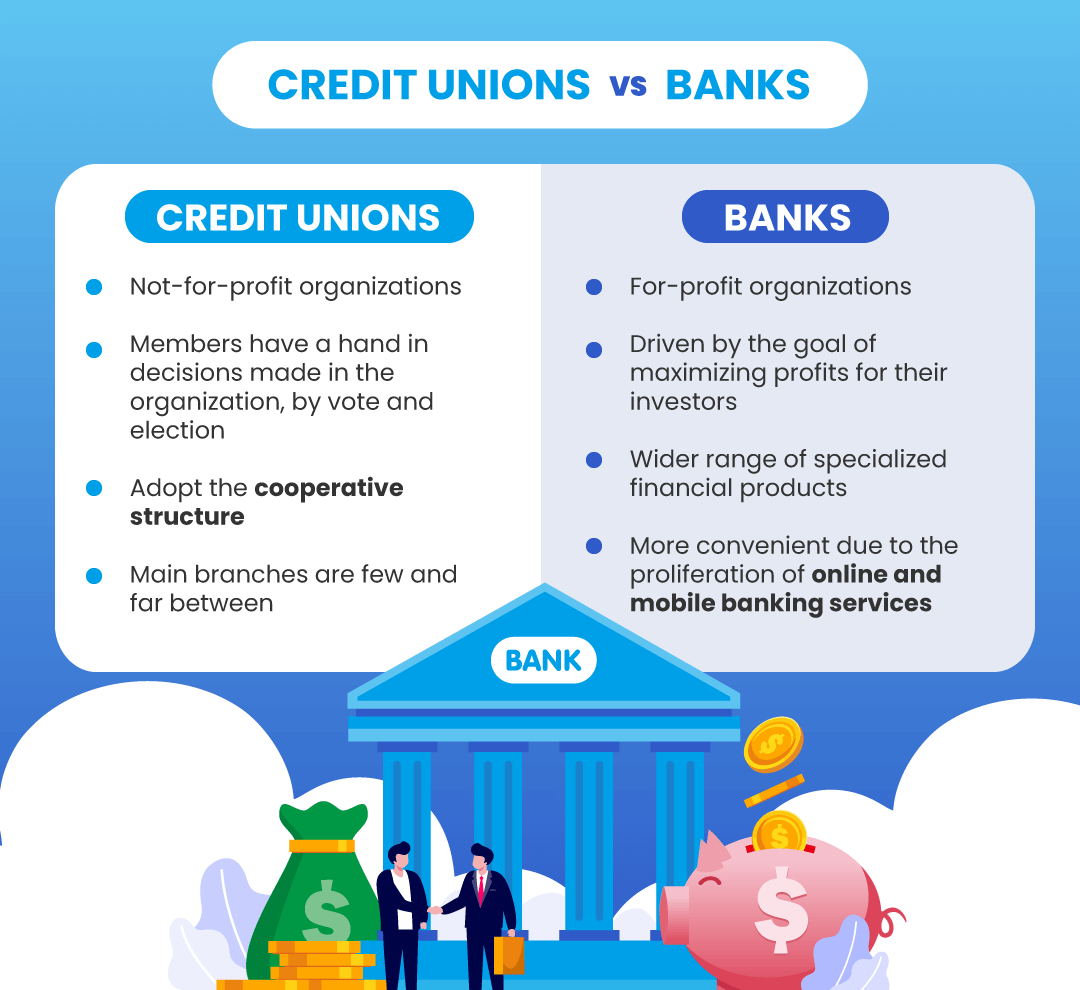

In order loans Blue Valley to make use of the residence’s collateral because of one of these alternatives, you will have to go through a process exactly like getting a beneficial home loan. You might use due to a bank, borrowing partnership, on the internet bank or any other lender that gives this type of household collateral points.

Loan providers often thought multiple circumstances, and additionally somebody’s loans-to-earnings ratio, loan-to-really worth proportion, credit score, and you will yearly income, said Michele Hammond, older home financing advisor on Chase Personal Visitors Household Financing. Simultaneously, to choose the number of guarantee inside the a house, a lender often implement an appraiser to find the economy worth of your house, that is centered on the standards and equivalent characteristics throughout the town.

As to the reasons play with house guarantee?

Tapping your residence collateral would be a handy, low-pricing solution to borrow large sums within beneficial rates of interest to buy household solutions or debt consolidation reduction.

If you’re looking to blow since you go and only spend for just what you’ve borrowed, when you’ve borrowed they, a beneficial HELOC is probably a far greater solution, claims Sean Murphy, secretary vice-president out-of collateral lending during the Navy Government Borrowing from the bank Commitment. But when you are searching for a fixed payment per month and you will a giant sum of money up front, a house equity financing most likely the more sensible choice.

7 how do you play with a property collateral financing

Discover couples limitations on how you can utilize your residence guarantee, however, there are numerous good ways to maximize of one’s mortgage otherwise credit line.

step 1. Home improvements

Do it yourself is one of the most preferred causes property owners just take aside domestic collateral loans otherwise HELOCs. In addition to while making property more comfortable for you, improvements could raise the home’s well worth and you may mark far more appeal off possible people once you sell it later on.

Family security is a superb option to funds high projects including a kitchen restoration that may raise an excellent residence’s worthy of through the years, Brunker claims. Repeatedly, such investments covers on their own by the improving the house’s really worth.

Another reason to adopt property collateral loan or HELOC to possess renovations is that you could subtract the eye paid on the family collateral fund all the way to $750,100000 if you are using the mortgage money to shop for, build or considerably boost the house one to obtains the borrowed funds.