Folks have infamously used HELOCs even though buying automobiles and you will posting its lifetime. They usually have made use of the boost in their home beliefs to fund which paying. And whenever brand new economy and you can home prices came crashing down, people experienced challenges appointment their obligations money. As a result, as his or her property were utilized since collateral, they might score foreclosed towards.

not, once more, like any other device, I do believe when the made use of wisely, it assists speeds the structure of your investment profile.

Assistance with a downpayment

Imagine if which you currently own two resource services. You want to add more, however, you are already restricted to the money you really have easily accessible. You can remove a great HELOC on one of those, and employ you to definitely borrowing and make a down-payment into the several other possessions.

Then you may play with income out of expenditures along with your time job to settle one credit line, and you may get it done once more.

Due to the fact an excellent HELOC is easily obtainable, you’ll be able it might help you get a residential property quickly plus cash. Following once getting the property, you can remove financing into the property and spend off the HELOC instantaneously.

A good HELOC would allow you to definitely buy an inactive real property price when you do not have the cash readily available.

Directly I have over exactly that. Once again, Really don’t wish to leave huge amounts of cash sitting from inside the bank accounts, however, I happened to be given an effective investment possibility from inside the a beneficial syndication package. Although not, I didn’t somewhat feel the full count available to meet with the minimal.

We understood one due to my day job or any other cash moving assets, I’m able to eliminate sufficient in the HELOC to cover the brand new financing and you will afford the financing off in two weeks. Which will be what I did so. The brand new investment I produced not only supplies more money disperse for me it is including admiring from inside the value.

These are merely a few examples of utilizing influence to increase your own profile. At all, unused collateral is best acted upon to you for individuals who can do they sensibly.

It is extremely vital that you observe that like with one thing, an excellent HELOC shall be put carefully. As you may be aware, leverage is actually a dual-edged blade. It does multiply your yields but could perform the same getting the losings.

If you are not able to pay the bill on the line out of borrowing unconditionally, your exposure losing the property you devote up just like the collateral. This might trigger a fairly disastrous effects.

Are you willing to Pull out good HELOC to the an investment property?

It is a common question, as the typically, HELOCs are notion of in relation to a primary house. But not, there isn’t any cause you can’t carry out the same into a rental property.

Really the only obstacle ‘s the financial. Its not all lender will allow a residential property to be used as the source of equity, mainly because of the brand new seen volatility that is included with local rental attributes.

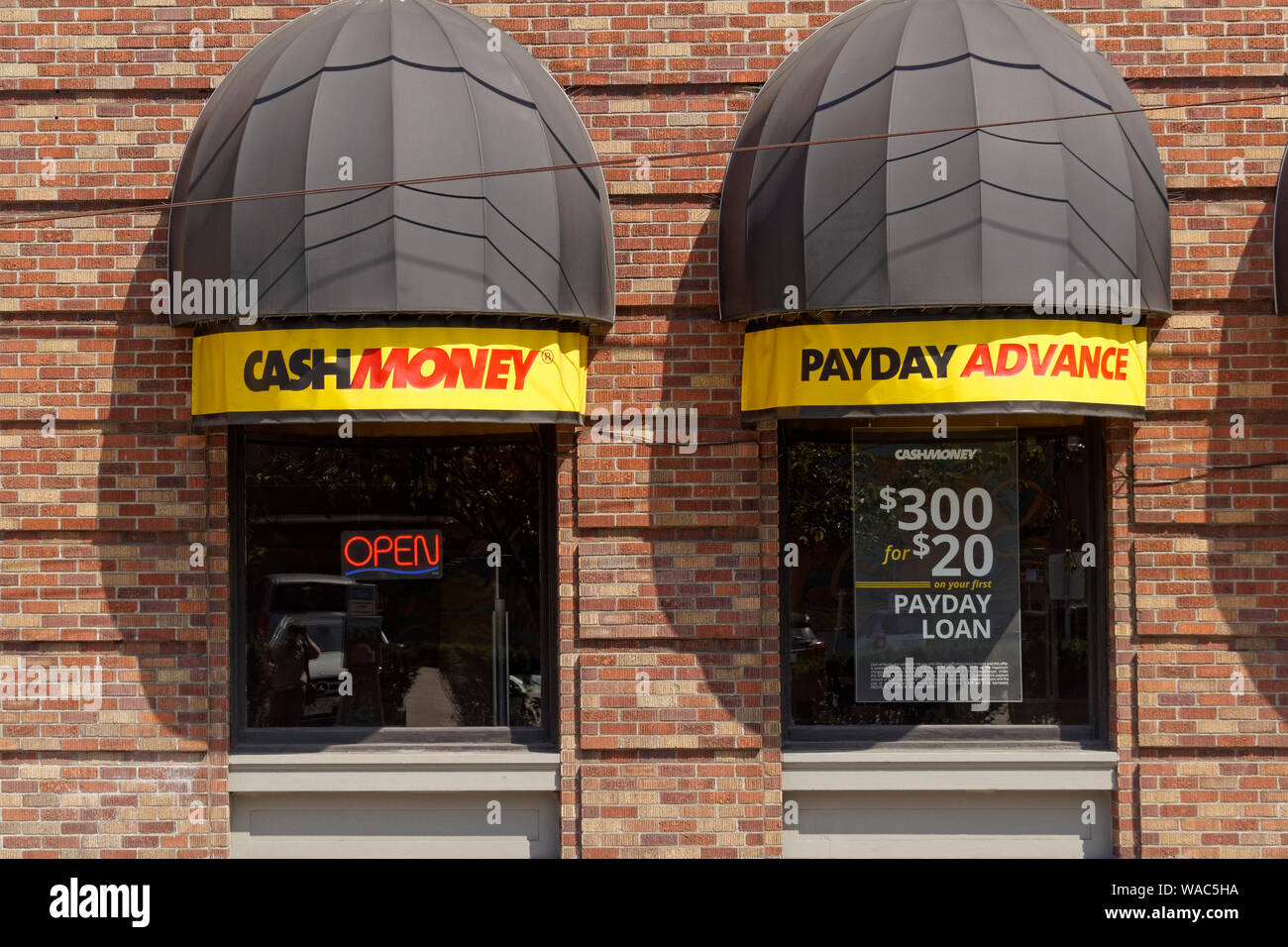

For that reason, interested in a lender ready to create a great HELOC toward an investment possessions can be a little challenging. To get you to definitely, cash advance usa Brilliant AL it’s best to ask around your local area and you can search information.

HELOC vs Dollars-away Refinance

A HELOC could be regarded as another mortgage, in that when you have home financing already, they stays set up.

A cash-away re-finance, at the same time, pays off the present financial and you can takes its lay given that an effective various other home loan with assorted conditions.

One of the greatest differences between the 2, even when, ‘s the interest. Because it’s a mortgage, cash-out re-finance you can certainly do with possibly repaired or changeable attention cost.