When you’re StackSource generally operates in the commercial a house place, we have together with seem to helped real estate origin and you will build financing for 1cuatro unit home-based portfolios, for the caveat that there need to be 5+ full domestic equipment regarding the portfolio. Many dealers select these types of capital given that a beneficial gray town ranging from home-based mortgage loans, that will be studied for a buyers family pick, and you can commercial mortgage loans, which can be employed for industrial-have fun with attributes. .. but it need not be.

Financing terms

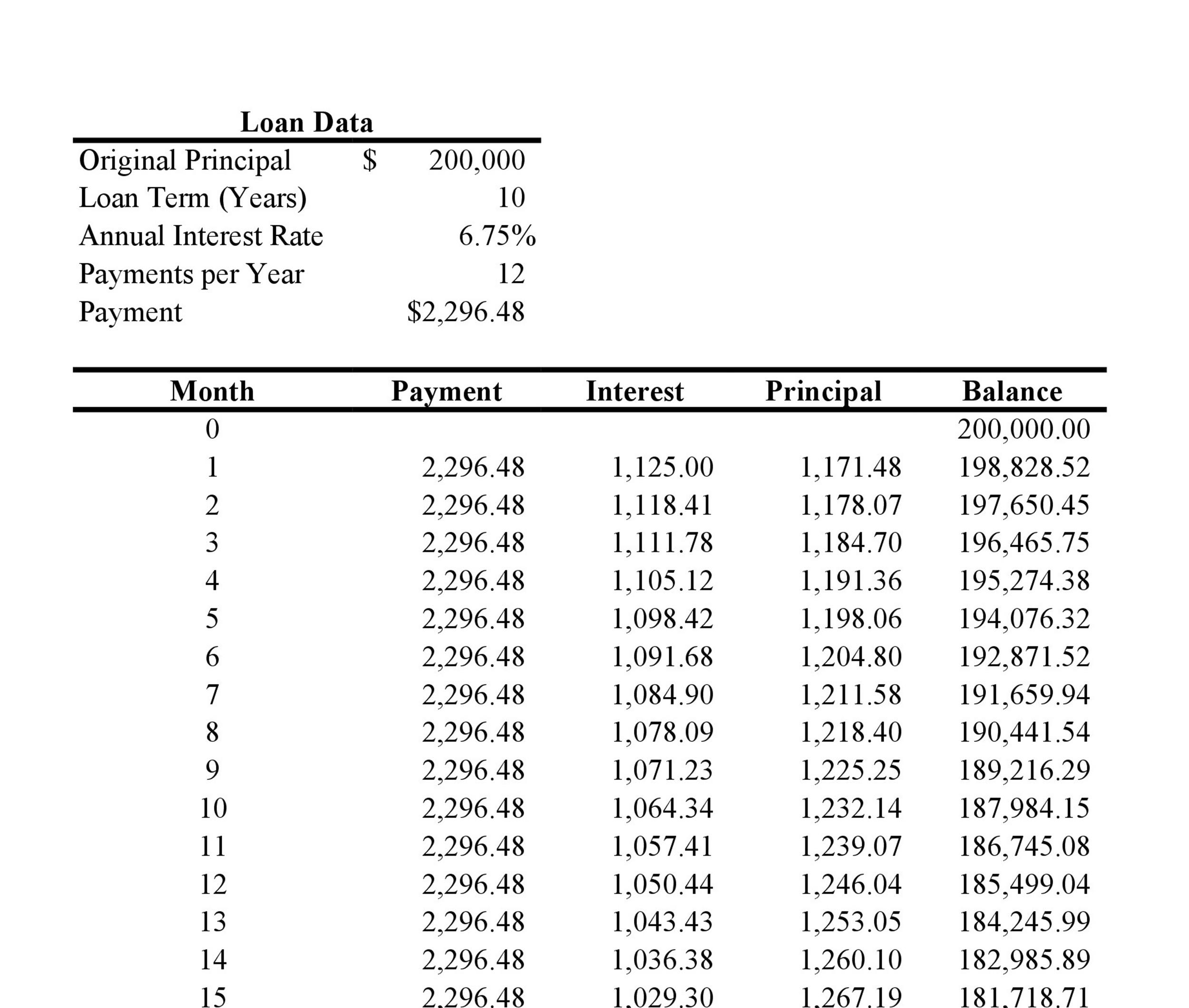

Particular industrial lenders provide thirty years repaired costs that are equivalent in order to conventional residential financing. The borrowed funds term try thirty years, the pace is fixed to your full three decades as well as the loan amortizes over three decades. Audio fairly simple, right? (It is!) This type of funds are usually given by individual loan providers that are not required so you can adhere to old-fashioned financial regulations. Most other more traditional loan providers (such as for example banking companies and borrowing unions) typically give commercial financing structures where in actuality the basic loan terms try 5, seven, otherwise a decade, that have amortizations varying out-of 15 in order to thirty years. Investors seeking to an even more residential financing design that have higher earnings will be on the lookout to possess 31 seasons amortizations.

Interest levels

Also the loan identity and you can amortization, rates are there at the top with respect to characteristics and you may son manage it are very different. Rates were sneaking up from inside the 2021, though he or she is nevertheless close all-time lows and you will dealers was still capable protect antique 5, eight, and 10 season fixed cost on the highest 3s in order to mid 4s, dependent on bank type, advantage place, mortgage size, power, property money, and debtor financial power and you will credit.

Personal lenders that usually bring 30 year repaired cost already bring cost regarding 4s and you will 5s, also depending on the things in the above list however, often even more founded for the borrower’s credit rating.

Power

Leverage is even an attractive issue and installment loans Houston MS the number of influence has yes see-sawed back-and-forth over the past 20+ weeks with COVID. To possess acquisitions, we are enjoying lenders give to 7580% of the purchase price otherwise appraised worthy of, whichever is lower.

Think about good refinance? Getting a good rates and you may identity refinance, lenders are regarding 7580% range, and for cash out, it is quite down at the 6575% LTV definition a loan provider deliver some cash out, if they commonly breaking a great 6575% LTV endurance based on a freshly appraised really worth. Oh and remember discover a seasoning several months where specific loan providers want individuals to hang services having 612+ months ahead of it believe bringing cash out, if you don’t, they will certainly just refinance current obligations and you may possibly security charges and you will closing costs.

Funding 1cuatro equipment profiles range from high costs than simply antique industrial properties and there’s simply alot more functions so you’re able to underwrite, appraise, and you can secure. It’s hard to place an accurate amount otherwise commission on the charges, because they create differ from the financial and it is about investor’s best interest to shop to and not just examine speed, name, and amortization all over loan providers, as well as fees and closing costs.

What more should a trader look out for?

Before for the 2021, lenders was in fact overloaded which have new loan applications to own commands and you will refinances. Rates was basically lowest and you may investors planned to pounce into the an effective assets. Loan providers cannot money every mortgage demand they gotten so they worried about the higher quality attributes. We saw of several lenders instituting the absolute minimum worthy of for every single assets, commonly regarding $75100k assortment. Both it indicates the typical property value inside the portfolio demands to be significantly more than which minimal endurance, and other moments this means the worth of regarding the collection has to be more than that it tolerance and one value of below one to really worth will be thrown out of your own profile. Regardless, loan providers appear to be worried about highest valued qualities and therefore normally correlates to better top quality characteristics.

Why would a trader work on StackSource?

For 1, StackSource enjoys a huge system having a good varied mixture of credit organizations across the country that can offer commercial money for examplecuatro unit assets portfolios. Of a lot loan providers shy of it asset sorts of because it requires high time and tips in order to underwrite, processes and you may intimate 14 product portfolio funds that it takes significant some time and a working system in order to source attractive financing selection. Of a lot commercial lenders dont specialize in quick profile loans, but could become reached using a romance that feeds her or him an enthusiastic productive pipeline of various credit solutions, making it simpler to own more substantial system such as StackSource to interact secret financial support relationship.