Post summation

- People from other countries otherwise nonresidents can also be invest in assets for the Southern area Africa since the people, otherwise through-joint possession or by obtaining shares inside the an entity one possesses possessions.

- Nonresidents have to import 50% of your own purchase price or equilibrium off cost via the Set aside Lender, from their very own foreign bank in order to a designated account (that’ll constantly become faith account of your move attorney) which have an authorized Southern African bank.

- Most of the foreigners, specifically nonresidents, must dedicate one to rand in the united kingdom for each rand it must acquire. The total amount foreigners otherwise nonresidents normally obtain is restricted in order to fifty% of the purchase price.

The brand new Southern area African possessions business has been a prime interest to possess overseas dealers, as a result of a favorable exchange rate and you will loads of luxury houses into the beautiful metropolitan areas. Overseas funding is expected to further increase because benefit slowly recovers throughout the Covid lockdowns.

Things to discover mortgage brokers getting foreigners in Southern Africa

People from other countries not resident inside the Southern area Africa, who will be eager to acquire property here, will perform therefore really otherwise jointly, or from the getting shares when you look at the a pals this is the registered proprietor away from a property.

step one. If you purchase assets by way of a house representative, they must be a subscribed person in the fresh Estate Company Products Board with a legitimate Fidelity Funds Certificate.

2. When you generate a deal to acquire and is also approved, an agreement regarding marketing would-be drawn up on the customer, provider and two witnesses to sign. So it offer try legally joining. If either the customer otherwise seller cancels new contract from the 11th hours, they truly are prosecuted to own costs incurred, particularly lost courtroom fees.

step 3. Both promote to purchase and the agreement out-of product sales demands to be comprehended just before he’s closed and you will recorded. You need to find separate legal services when the things was unsure.

cuatro. Possessions inside Southern Africa is sold voetstoets (as is). However, the consumer need to be told of all patent and hidden defects on the property.

5. Accessories and fittings was immediately as part of the income of one’s assets. Having clarity, these could be listed in the agreement of deals.

six. Electrical and beetle permits are required to confirm that the fresh electrical set up is compliant with statutory criteria and therefore the home is perhaps not plagued by the specific beetles. (The second certificate is often merely compulsory when you look at the seaside nations.) Specific countries want plumbing and fuel certificates.

7. The foreign people maybe not citizen otherwise domiciled for the Southern Africa need to dedicate one to rand in the nation for each rand they have to use. The quantity people from other countries or non-citizens is acquire is limited in order to fifty% of one’s purchase price. Recognition are expected by exchange manage authorities, that’ll depend on having the ability to show this new addition in order to Southern area Africa regarding an amount comparable to the text amount borrowed.

8. Finance companies will finance fifty% of your own pick worth of the house or property to possess nonresidents. Thus international investors have a tendency to either must provide good 50% deposit, or shell out bucks and you may expose the full count on Southern area Africa via the Put aside Financial to a specified bank account (that may usually end up being the believe account of the move attorney) which have a subscribed South African lender.

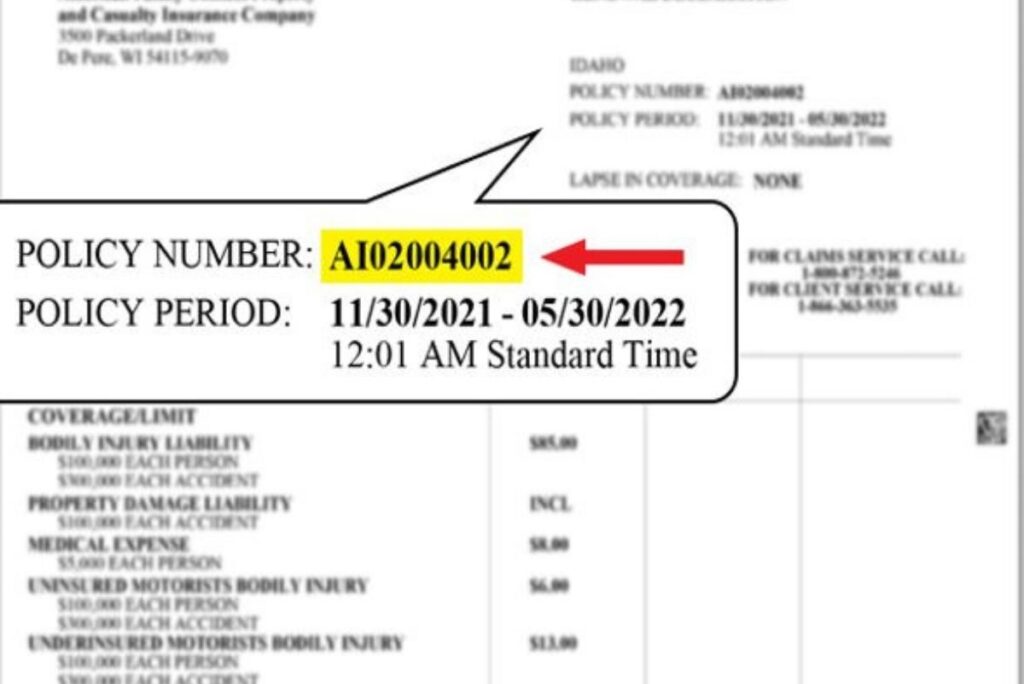

9. The latest listing of one’s deposit of one’s money acquired from a beneficial overseas supply is called an effective deal bill and may be hired because of the buyer as it is necessary towards the repatriation regarding finance when the property is at some point marketed.

10. In case it is a combined app, one applicant must earn at least R25 100 monthly, become 18 many years otherwise more mature as well as have a definite credit record.

Exactly what records am i going to you need whenever making an application for a home loan just like the a different trader?

- An individual Mortgage Interview Means, finalized and you may dated. Instead you could potentially done an on-line software which have ooba Lenders:

- A duplicate of your own ID otherwise both sides out-of a keen ID Card Or a different or South African passport Otherwise a-work permit allowing you to performs abroad.

- A paycheck Suggestions Or good payslip towards newest half a year (around submitting day).

- A duplicate out-of a full Package regarding Work.

- An individual Financial Interviews Function, signed and old. As an alternative you could done an internet software that have ooba Home loans:

Applying for home financing compliment of a-south African lender

ooba Mortgage brokers is Southern area Africa’s largest financial review service, and can let foreign people to find property into the South Africa after they make an application for a thread by way of a south African lender.

Potential buyers dont necessarily must unlock a bank account emergency cash for single mothers having you to definitely industrial bank, as they possibly can import fund right from their to another country account on their home loan membership.

We are able to fill out your application in order to several Southern area African banking companies, enabling you to contrast packages and have the best offer to your your property financing.

I supply a selection of systems which can improve real estate process easier. Start by our very own Bond Calculator, after that fool around with the Bond Indicator to see which you really can afford. Eventually, before you go, you might submit an application for a mortgage.